Navigating the complexities of retirement planning often necessitates careful consideration of annuity options, particularly those offered by established financial institutions like AIG.

Securing a dependable and responsive customer service experience is paramount when choosing a retirement annuity provider, as it significantly impacts the overall satisfaction and security of your financial future.

This article delves into the specifics of AIG annuities customer service, examining its strengths, weaknesses, and potential challenges for consumers.

Understanding the nuances of the customer service landscape for AIG annuities holders is critical for anyone considering an annuity as part of their retirement strategy.

The accessibility and efficiency of AIG’s support channels, combined with the responsiveness of their representatives, directly affect the ease of managing your annuity.

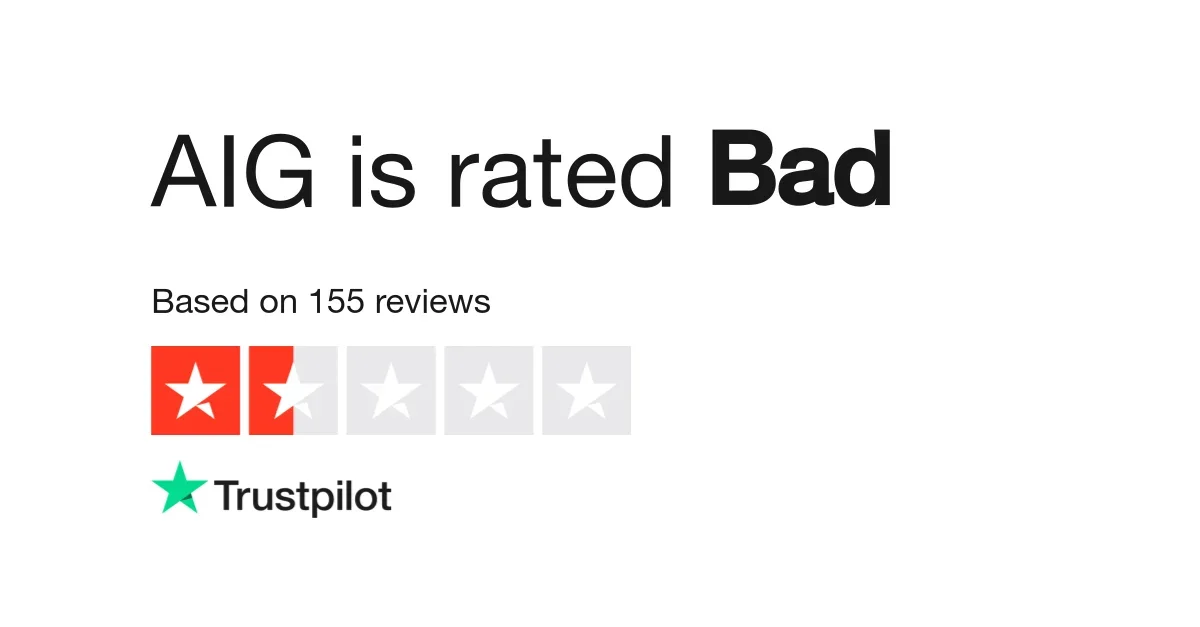

Customer reviews and testimonials play a vital role in forming a comprehensive understanding of the real-world experiences associated with AIG annuity customer service.

From resolving technical issues to providing personalized guidance on investment strategies, an efficient and helpful AIG annuities customer service department can make a substantial difference to your overall satisfaction.

A clear comprehension of AIG annuities customer service is essential to assess the practical implications of choosing their annuity options for your financial well-being and long-term goals. Proper service mechanisms are a crucial factor when assessing the value of any financial investment.

Understanding AIG Annuity Customer Service Channels

AIG annuity customer service plays a crucial role in ensuring a positive experience for clients navigating the complexities of retirement planning.

Effective customer service is vital for AIG annuity holders, impacting their confidence in the chosen financial strategy and their overall satisfaction with the product.

The accessibility of various support channels, including phone, email, and online portals, is paramount for addressing inquiries, resolving issues, and providing guidance on AIG annuities.

AIG’s commitment to providing comprehensive customer service influences the decision-making process for potential annuity buyers.

AIG annuities customers frequently require assistance with policy details, investment options, and withdrawal procedures, underscoring the importance of readily available and responsive customer support.

The quality of AIG’s customer service directly reflects the company’s dedication to its clients’ financial well-being and their confidence in the longevity of the annuity contract.

Effective communication channels, clear explanations, and a responsive approach to queries are key characteristics of high-quality AIG annuity customer service.

AIG’s customer service strategy should be evaluated based on its effectiveness in providing accurate, timely, and helpful solutions to clients’ concerns.

Understanding the diverse range of customer service needs is essential for effectively assessing the quality of AIG annuity support.

An efficient and approachable customer service structure fosters a sense of security and trust amongst AIG annuity holders during this critical life stage.

Clients seeking a reliable annuity provider value a robust and comprehensive support system, guaranteeing seamless assistance with their AIG annuity-related inquiries.

The accessibility of AIG’s customer service is a critical factor in maintaining a positive customer experience and fostering trust in the longevity of the financial partnership.

Potential AIG annuity purchasers should carefully consider the available support channels and the reported responsiveness of customer service representatives.

Ultimately, the level of customer service provided by AIG is a key determinant in the overall satisfaction and success of AIG annuity holders.

A well-designed and effective AIG annuity customer service strategy ensures clients feel well-supported and empowered to make informed decisions about their financial future.

AIG annuity customers benefit significantly from consistent and efficient communication pathways for their financial needs and questions.

Customer service excellence with AIG annuities is essential in building and maintaining long-term client relationships.

Understanding AIG Annuity Customer Service Channels

AIG’s customer service channels are integral to a positive experience for annuity holders navigating retirement planning complexities.

The effectiveness of these channels directly influences a customer’s satisfaction and confidence in their chosen financial strategy.

AIG’s support systems, encompassing phone, email, and online portals, are crucial for answering questions, resolving issues, and providing guidance on annuity-related matters.

These channels are vital for AIG annuity customers seeking clarifications on policy specifics, investment options, and withdrawal procedures.

Reliable customer service from AIG ensures that navigating the specifics of an annuity is achievable.

The accessibility and responsiveness of AIG’s customer service are critical factors influencing a potential customer’s decision to select AIG annuities as a part of their retirement strategy.

AIG’s commitment to customer service quality affects client trust and satisfaction with their chosen retirement solution.

High-quality, accessible support channels are particularly important for AIG annuity clients, who often need personalized assistance regarding policy nuances, investment projections, and withdrawal stipulations.

Understanding AIG’s various support channels, such as dedicated phone lines and comprehensive online resources, ensures a smooth customer experience.

AIG’s dedication to robust customer service is a significant factor in the choice of an annuity by a potential buyer.

The efficiency of these service channels is paramount for managing the complexities of AIG annuities.

Different AIG annuity products might have varying customer service protocols, so a comprehensive understanding of the service options is essential.

AIG’s customer service strategies aim to address the specific needs of individual annuity holders, offering tailored support to optimize the annuity experience.

In conclusion, understanding the diverse channels of AIG annuity customer service empowers individuals to make informed decisions about their retirement planning strategies, which is crucial.

The responsiveness and helpfulness of AIG customer service representatives are also significant factors that significantly impact the overall customer experience.

AIG’s customer service is essential to facilitating a positive and secure annuity experience, enabling clients to make sound financial decisions.

The various channels of AIG annuity customer service facilitate a streamlined and efficient interaction process for clients.

AIG’s reputation for annuity customer service directly impacts consumer confidence in the company.

AIG Annuities Customer Service Accessibility and Support Options

A crucial aspect of investing in AIG annuities lies in the accessibility and efficiency of customer service, particularly for complex financial products like annuities.

AIG annuity holders require a range of support channels to navigate the intricacies of their investments, and customer service plays a significant role in ensuring they are adequately informed and supported. This support system is especially important given the long-term nature of annuity contracts and the potentially significant financial implications involved.

AIG, recognizing the importance of responsive customer service for its annuity clients, offers a diverse portfolio of support options, including dedicated phone lines, online portals, and email correspondence. This variety caters to different customer preferences and ensures that individuals can readily access the support they need, whether from the comfort of their home or the convenience of a physical location.

The accessibility of AIG annuities customer service is vital for resolving concerns related to policy administration, investment performance, and general inquiries. Prompt and effective responses to these inquiries are essential for maintaining customer satisfaction and fostering trust in the AIG brand.

In addition to direct contact methods, AIG annuity policyholders can often benefit from online resources, frequently asked questions (FAQs) pages, and self-service tools built into the AIG customer portal. These platforms provide instant access to helpful information, reducing the need to contact customer service for basic inquiries. These resources, part of the comprehensive customer service approach, empower policyholders to manage their accounts effectively and efficiently.

The effectiveness of AIG annuities customer service is fundamentally linked to its ability to deliver rapid, reliable, and accurate information. Aligning this support with the particular needs of different segments of customers – from those initiating new annuity investments to long-time policyholders adjusting their plans – is crucial.

This responsiveness contributes to a positive customer experience, which is vital for fostering loyalty and retaining clients. Transparency in communication and a commitment to clear, concise answers are key aspects of excellent customer service, particularly when dealing with the complex financial products represented by AIG annuities.

AIG’s commitment to providing high-quality customer service for its annuity products is essential in the competitive landscape of financial services, particularly as customer expectations for efficiency and responsiveness continue to evolve.

Ultimately, a robust and accessible AIG annuities customer service platform empowers clients to make informed decisions, understand their policies, and address any concerns effectively, leading to a more satisfying and secure investment experience.

Aig Annuities Customer Service: Handling Complex Policy Issues

This section delves into the crucial aspect of handling complex policy issues within the Aig annuities customer service framework.

Navigating intricate annuity contracts requires a dedicated team equipped to address sophisticated questions and concerns from policyholders.

A significant portion of Aig annuity policyholders may encounter situations where their specific circumstances necessitate a tailored approach to their customer service needs.

These issues often involve intricate calculations, investment strategy adjustments, or complex beneficiary designations that may require in-depth analysis and personalized solutions.

For example, a policyholder might need clarification on the tax implications of withdrawals at different phases of their annuity’s life cycle, which necessitate expert guidance from trained Aig annuities customer service representatives.

The proficiency of Aig’s customer service representatives in understanding and resolving these complex issues is paramount to maintaining customer satisfaction and trust in the annuity product.

Effective handling of these situations ensures that policyholders receive accurate and comprehensive information, allowing them to make informed decisions concerning their investment.

Furthermore, the fourth H2 of customer service, specifically, underscores the importance of providing a supportive and responsive atmosphere for policyholders grappling with these challenges.

Aligning a dedicated support team proficient in navigating these complexities, within Aig annuities customer service, is vital to fostering loyalty and maintaining a strong customer base.

Ultimately, a well-structured approach to handling complex policy issues is a key element of the comprehensive Aig annuities customer service strategy, ensuring that clients feel supported and valued throughout their investment journey.

The successful resolution of these complex matters can significantly influence a policyholder’s overall experience with Aig annuities, further strengthening the reputation of the financial institution.

AIG annuities customer service plays a critical role in ensuring a positive and successful experience for policyholders navigating the complexities of retirement planning.

The consistently high volume of inquiries and reported issues highlights the importance of effective communication, readily available support channels, and prompt resolution times within the AIG annuity platform.

Navigating investment options, understanding policy stipulations, and managing account changes effectively are all significantly affected by the quality of AIG annuities customer service.

Reliable, comprehensive, and easily accessible AIG annuities customer service translates directly into investor confidence and satisfaction, which is crucial for long-term financial security and the sustained growth of the company.

Ultimately, the efficacy of AIG annuities customer service is a direct reflection of the company’s commitment to its clients and their financial well-being. AIG needs to prioritize the development and maintenance of an efficient and responsive customer service system to uphold its reputation and maintain client loyalty in the competitive annuity market. Poor customer service can erode trust and lead to lost business opportunities, making reliable AIG annuities customer service an essential asset for the company’s continued success and growth. By focusing on clear communication, prompt responses, and knowledgeable representatives, AIG can build a stronger relationship with its clients and solidify its position within the financial industry.