Navigating the complexities of retirement planning often necessitates a dependable and responsive customer service network, particularly when dealing with investment products like annuities.

AIG annuities, a significant player in the retirement income market, provide a crucial financial safety net for many Americans.

However, the accessibility and quality of customer service can dramatically impact the experience of policyholders, significantly influencing their trust and satisfaction with the entire process.

Understanding the specifics of AIG annuity customer service is vital for those considering this avenue for retirement planning, as it directly affects the ease of accessing support and the efficiency of resolving potential issues.

The reliability of the customer service team and their ability to provide timely assistance can drastically affect the efficacy of these retirement planning instruments.

AIG annuity policyholders require a support system that effectively addresses inquiries, concerns, and any questions arising from the complexities of an annuity contract.

This article will delve into the specifics of AIG annuity customer service, exploring the various channels available, the quality of assistance provided, and the potential challenges policyholders might face.

By examining the different aspects of AIG annuity customer service, this article equips readers with the knowledge to make informed decisions about their retirement financial planning and ensures they have the tools to manage any arising concerns effectively.

Ultimately, a comprehensive understanding of AIG annuity customer service is crucial for prospective policyholders and current clients to confidently navigate the complexities of retirement income planning and optimize the benefits of these critical investment products.

AIG Annuity Customer Service: A Cornerstone of Trust and Satisfaction

AIG annuity customer service represents a critical component of the overall experience for policyholders, significantly impacting their satisfaction and confidence in their retirement planning strategy.

The quality of customer interactions directly influences the perception of AIG annuities as a reliable and supportive financial resource. AIG’s approach to customer service plays a vital role in ensuring that policyholders feel comfortable navigating the complex world of retirement investment products.

Effective customer service channels, encompassing phone support, email communication, and online portals, are essential for addressing policyholder inquiries and concerns promptly and efficiently.

Policyholders need clear, concise, and accurate information about AIG annuity products, features, and benefits. Responsive customer service empowers policyholders to make informed decisions regarding their financial future, ensuring they fully understand their options.

AIG annuity customer service, therefore, stands as a critical differentiator in a competitive market. A strong support network directly contributes to the long-term success and growth of the AIG annuity program.

The efficiency and professionalism of the AIG customer service team can significantly impact a policyholder’s decision-making process. Reliable support reduces uncertainty and fosters a sense of trust in the annuity product and the financial institution.

Accessibility to customer support agents, whether through readily available phone numbers, email addresses, or online chat functionality, is paramount to policyholder engagement and satisfaction. Quick issue resolution and proactive assistance demonstrate a commitment to client well-being.

The depth of knowledge possessed by customer service representatives regarding AIG annuity products and policies directly affects the quality of support provided. Thorough knowledge ensures that policyholders receive accurate and tailored solutions to their individual needs.

AIG annuity customer service extends beyond simple issue resolution. It involves building lasting relationships with policyholders, creating a positive experience that extends beyond the initial purchase and into the long-term management of their retirement savings.

In summary, the efficacy of AIG annuity customer service is a direct reflection of the company’s commitment to its policyholders. Effective service fosters trust, facilitates understanding, and enhances overall satisfaction within the AIG annuity framework.

AIG Annuity Customer Service: Empowering Policyholders

AIG annuity customer service acts as a vital link between policyholders and the company, shaping their experience and trust in the retirement planning process.

Effective communication channels and knowledgeable representatives are essential for resolving policyholder inquiries and concerns efficiently.

AIG annuity customer service needs to consistently deliver accurate and timely information regarding policy details, product features, and potential benefits.

The accessibility and responsiveness of AIG’s customer service representatives are directly tied to the overall perception of the annuity product’s value proposition.

AIG’s commitment to customer satisfaction influences policyholders’ confidence in the security and longevity of their retirement investments.

AIG annuity customer service impacts the overall satisfaction and reliability that policyholders associate with their investment choices.

The availability of various customer service options, such as phone support, email correspondence, and online portals, ensures broad accessibility for policyholders.

A dedicated and well-trained customer service team plays a crucial role in handling policyholder concerns regarding claims, account updates, and policy modifications.

The prompt and professional resolution of policyholder issues builds confidence and loyalty, fostering positive interactions with AIG.

This efficient and readily accessible customer service process is crucial for successful engagement in the complex world of retirement planning using AIG annuities.

Well-structured FAQs and readily available online resources, part of AIG’s customer service strategy, aid policyholders in finding quick answers to common questions and concerns.

AIG’s understanding of the specific needs and expectations of its policyholders is a significant factor in building a robust customer service system.

By prioritizing effective and responsive customer service, AIG can build long-term relationships with policyholders, fostering trust and satisfaction in their retirement solutions.

Prompt answers to policyholder questions and proactive engagement are critical components of a superior AIG annuity customer experience.

Ultimately, the quality of AIG annuity customer service directly affects the success and reputation of the company’s retirement products.

Consistent effort in improving the customer service experience for AIG annuity products ensures policyholders feel supported and well-informed throughout their financial journey.

The ability of the customer service team to address specific needs and concerns with AIG annuities plays a significant role in customer satisfaction.

AIG’s customer service approach, if effective, can significantly enhance customer confidence and satisfaction with the annuity products.

This robust system of support is integral to navigating the intricacies of retirement planning with AIG annuities.

Aig Annuity Customer Service Channels and Accessibility

This section dives into the diverse channels available for aig annuity customers seeking assistance, emphasizing their accessibility and usability.

A comprehensive approach to aig annuity customer service acknowledges the variety of needs and preferences among policyholders, thereby offering multiple avenues for interaction.

The availability of various channels, like phone support, online portals, and email correspondence, significantly impacts the efficiency and effectiveness of aig annuity customer service.

Understanding the accessibility of these channels, particularly for individuals with disabilities, is crucial for ensuring equitable service provision.

This encompasses features like accessible website design, assistive technology compatibility, and dedicated support channels for those with visual, auditory, or cognitive impairments.

The ease of access to aig annuity customer service impacts policyholders’ overall experience. A smooth and intuitive process fosters trust and confidence in the company.

Aig annuity customers often require assistance navigating the complexities of their investment products, including managing accounts, understanding policy terms, or addressing any concerns related to their policy.

Customer service channels for aig annuity policies are thus critical to provide clear guidance and timely resolution of inquiries.

Robust online resources and FAQs are key for self-service support. These can help customers find answers to common questions without the need for human intervention, reducing wait times for those seeking assistance through other avenues.

The accessibility and clarity of the channels chosen for aig annuity customer service are key to the user experience.

For example, a well-structured website with clear navigation can make it easy for policyholders to locate the information they need, leading to a more satisfying experience.

A robust customer service phone line with well-trained representatives can quickly answer complex questions and resolve problems.

The effectiveness of the aig annuity customer service approach directly impacts customer satisfaction, retention, and the company’s reputation in the market.

Therefore, providing multiple channels for aig annuity policyholders to reach customer service is essential to a strong customer support model.

Finally, timely and responsive service is key to handling any urgent or critical issues quickly and effectively.

This aspect of aig annuity customer service reflects the company’s commitment to its clientele and demonstrates a proactive approach to addressing their needs.

AIG Annuity Customer Service Accessibility

A key aspect of a robust aig annuity customer service experience is accessibility, encompassing various factors that ensure ease of interaction and issue resolution for policyholders.

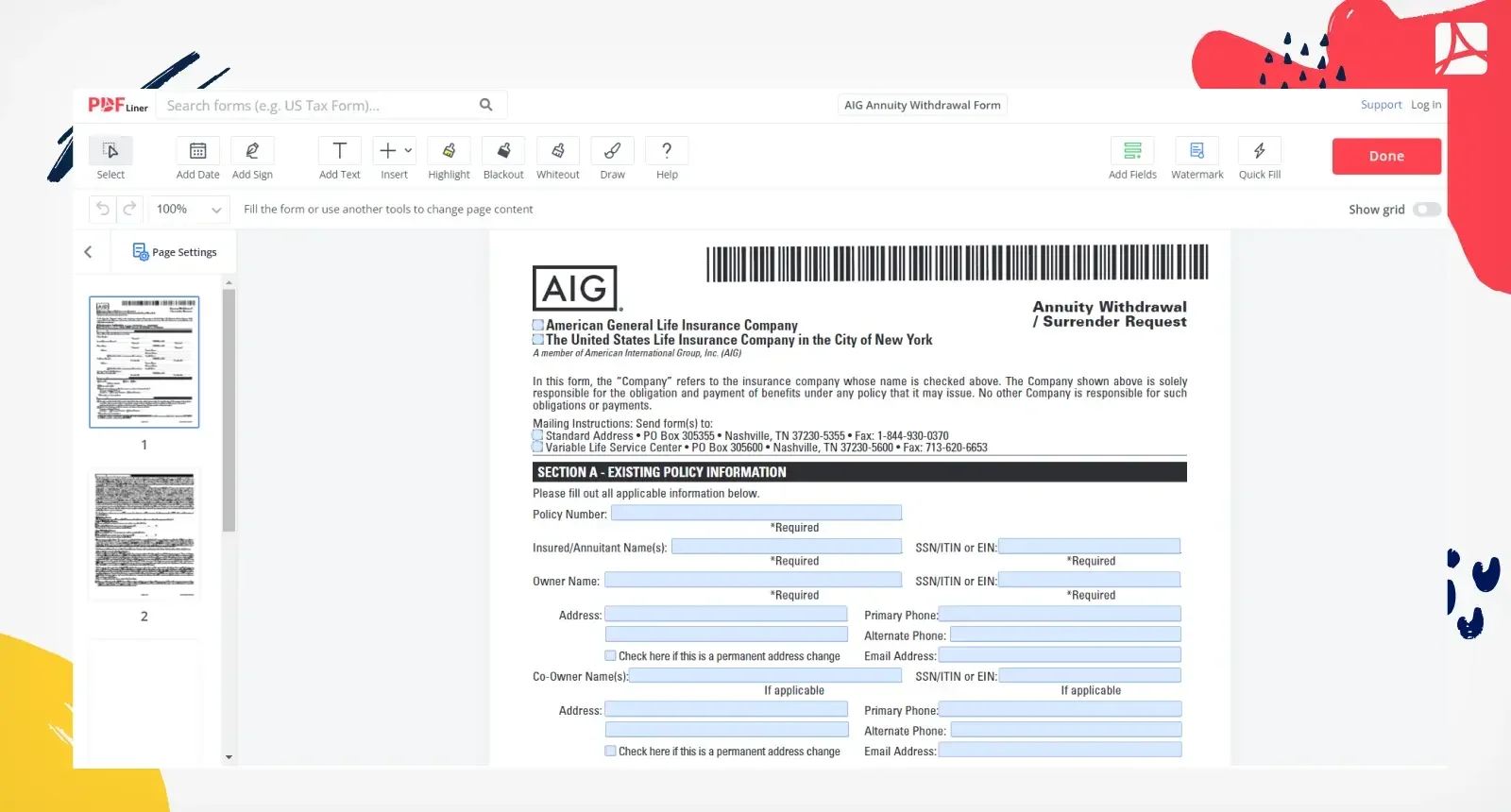

This includes readily available communication channels, such as phone lines, email, and online portals specifically dedicated to annuity inquiries. A dedicated customer service team with comprehensive training on annuity products and procedures is crucial for timely and accurate responses.

The effectiveness of these channels is directly tied to the efficiency with which aig annuity customers can navigate them and receive assistance. Clear and easily understandable FAQs, self-service tools, and online resources are vital components of a customer-centric accessibility strategy.

The accessibility of aig annuity customer service is not limited to communication methods. It also encompasses the physical accessibility of the service representatives, as well as any additional support services that may be needed by diverse segments of the customer base.

In the context of aig annuity customer service, accessibility directly translates to improved customer satisfaction and retention. Satisfied customers are more likely to recommend the products and services offered by AIG, ultimately contributing to the company’s overall success. AIG’s commitment to accessibility in its annuity customer service initiatives demonstrates a dedication to building and maintaining positive client relationships.

Furthermore, accessibility is critical for compliance with regulations designed to protect the rights of consumers in financial services. By ensuring all customers, regardless of their background or circumstances, can easily access and utilize the customer service offered by AIG for their aig annuity plans, the company is adhering to ethical and legal standards.

Accessibility considerations should also address potential language barriers, providing multilingual support options and resources when necessary. This inclusivity extends to customers with disabilities, providing alternative communication methods and ensuring the accessibility of online resources and support channels.

AIG annuity customer service plays a crucial role in ensuring a positive and fulfilling experience for policyholders navigating the complexities of retirement planning.

The quality of this service directly impacts the perceived value of the annuity product, influencing customer satisfaction and, ultimately, long-term retention.

Effective AIG annuity customer service fosters trust and confidence in the product, allowing policyholders to feel secure in their financial future and empowered to make informed decisions.

From initial product selection and enrollment to ongoing support and claim processing, responsive and knowledgeable agents are essential for navigating the often-technical aspects of annuity contracts.

Positive interactions with AIG annuity customer service representatives can translate into a more seamless and ultimately rewarding investment journey for policyholders. Addressing concerns promptly, providing accurate and comprehensive information, and demonstrating genuine empathy are critical components of superior customer service. Ultimately, the reputation and success of AIG annuities hinges on the consistent delivery of high-quality customer service that caters to individual needs and promotes long-term client relationships. Therefore, understanding and valuing AIG annuity customer service is paramount for both individual policyholders and the broader financial security of those utilizing this investment vehicle.

In conclusion, the quality of AIG annuity customer service directly impacts the overall experience for policyholders, influencing their trust and ultimately affecting the long-term success of the product. Consistent, responsive, and knowledgeable service is not just a desirable feature; it is a critical component for building a robust and thriving annuity business.