Navigating the complexities of modern payment processing often necessitates a robust and responsive customer service system, particularly for businesses reliant on seamless transaction flows.

Cardconnect, a pivotal player in the industry, provides a suite of services integral to numerous businesses, and its customer service infrastructure directly impacts their success.

Understanding the quality of Cardconnect customer support is crucial for businesses seeking streamlined payment processing and efficient problem resolution.

A well-managed customer service experience with Cardconnect can translate to faster transaction times, improved reconciliation accuracy, and ultimately, increased profitability.

This article delves into the intricacies of Cardconnect customer service, examining its strengths and weaknesses, and considering the impact on businesses across various sectors.

From resolving technical issues impacting card processing to providing tailored onboarding support, effective customer service is paramount for optimizing Cardconnect’s functionalities.

The accessibility of support channels, the responsiveness of support representatives, and the clarity of provided solutions directly correlate with user satisfaction and, consequently, business growth.

Businesses choosing Cardconnect must prioritize evaluating the customer service experience, recognizing its crucial role in mitigating potential disruptions to their operations and maximizing the platform’s full potential. Choosing the right payment processing partner with robust customer service support is key to any business succeeding in the digital age.

Cardconnect’s Customer Service: A Foundation for Seamless Transactions

Cardconnect’s reputation hinges significantly on the quality of its customer service, which directly impacts the success of businesses using its payment processing solutions.

Businesses rely on Cardconnect’s platform for critical transaction processing, and a robust customer service department plays a key role in ensuring smooth operations and timely issue resolution.

A swift and effective response to support inquiries can prevent delays in transactions, leading to potential revenue loss.

Cardconnect customer service teams must possess a deep understanding of the platform’s complexities and be equipped to handle diverse customer needs, from basic account management queries to complex technical troubleshooting.

Effective communication channels and easily accessible support resources are essential elements of a strong customer service strategy for card processing platforms like Cardconnect.

The proficiency of Cardconnect’s customer service agents directly correlates with the overall user experience for businesses. Prompt responses and accurate problem-solving strategies reduce frustration and downtime, allowing businesses to focus on core operations.

For businesses navigating the nuances of payment processing, a reliable cardconnect customer service team is a vital asset, fostering trust and confidence in the platform’s functionality.

Cardconnect’s approach to customer support needs to cater to varied needs across different industry verticals. This includes providing tailored solutions for specific business requirements and supporting the diverse processes unique to these sectors.

Customer satisfaction surveys and performance metrics provide valuable insight into the effectiveness of Cardconnect’s support operations. Regular monitoring and analysis of these metrics help identify areas for improvement, enhancing service quality and creating a positive customer experience.

Ultimately, the effectiveness of Cardconnect customer service is judged by the ability to resolve issues rapidly and efficiently, thereby facilitating seamless and uninterrupted transaction flows for businesses across the spectrum of industries.

Maintaining high standards in customer service is crucial for Cardconnect to retain existing customers and attract new ones, underscoring the importance of a dedicated team trained in handling intricate payment processing issues.

Cardconnect’s Support Channels and Accessibility

Cardconnect’s support channels are crucial for businesses to effectively leverage its payment processing services.

Multiple avenues for contacting Cardconnect customer service are essential for addressing diverse needs and ensuring swift issue resolution.

A robust support website, including FAQs, tutorials, and downloadable resources, empowers businesses to troubleshoot common issues independently.

Dedicated phone support lines, equipped with knowledgeable representatives, handle complex inquiries requiring personalized assistance.

Prompt responses to support tickets and a clear ticketing system ensure that urgent problems receive immediate attention, minimizing any disruption to payment processing.

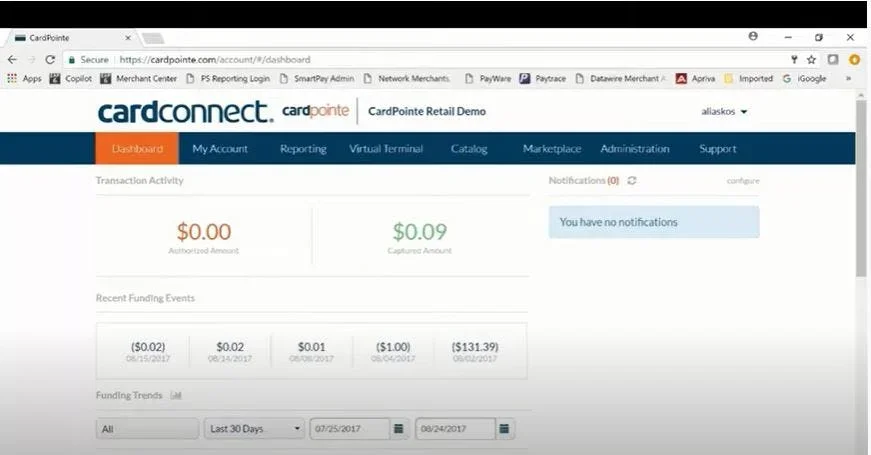

Cardconnect’s online support portal, complete with a knowledge base and self-service options, caters to various customer needs.

The availability of diverse communication channels, including email support, ensures accessibility for businesses requiring specific methods of communication, tailored to address unique needs.

Effective communication channels and the provision of clear FAQs, guides, and helpful documentation help to streamline the customer service experience for Cardconnect users.

The seamless integration of these support channels contributes to a cohesive support system, facilitating efficient problem-solving and promoting a positive user experience with the Cardconnect platform.

Furthermore, a well-structured knowledge base, regularly updated with pertinent information regarding the platform, empowers users to find answers quickly and independently.

This accessibility directly translates into a smoother workflow for businesses relying on Cardconnect for processing transactions, maintaining a seamless flow of financial operations.

An efficient support system enables businesses to resolve technical issues quickly, minimizing the risk of costly delays in transaction processing.

Cardconnect’s commitment to providing readily available and varied support channels fosters a sense of security and confidence in its services, which directly benefits the business’s reliance on the platform.

This availability directly enhances the user experience by providing a variety of methods for accessing support, allowing users to choose the channel best suited to their needs.

The integration of diverse channels—online, phone, and email—provides flexibility and ensures that businesses can receive support at their convenience.

Such a well-rounded support strategy allows businesses using Cardconnect’s payment processing solutions to promptly address any challenges, ensuring a smooth workflow and uninterrupted transaction processing.

The availability of robust support channels allows businesses to focus on their core operations, while Cardconnect ensures the smooth functioning of the payment processing infrastructure.

The efficiency of Cardconnect’s support structure plays a significant role in the overall success of businesses that depend on the platform’s reliability.

CardConnect Customer Support Channels and Efficiency

CardConnect’s customer service strategy hinges upon providing multiple avenues for support, ensuring quick resolution of issues and a positive customer experience.

A robust and efficient customer service system is crucial for any payment processing company, especially one like CardConnect, that deals directly with merchants and their transaction needs.

The effectiveness of CardConnect’s customer support channels plays a vital role in maintaining merchant satisfaction and fostering a positive brand perception.

CardConnect’s commitment to exceptional customer service directly influences merchant adoption and retention, which is a key driver of success in the competitive payment processing industry.

CardConnect’s comprehensive customer support approach encompasses a range of options, ensuring that merchants can access assistance tailored to their specific needs.

These channels often include a dedicated customer support team readily available through phone lines, offering prompt and personalized assistance for merchants dealing with account-related issues, transaction problems, or system malfunctions.

A well-organized knowledge base, accessible through an online portal or help center, provides immediate self-service options, allowing merchants to find solutions to common issues independently.

CardConnect often provides comprehensive online documentation, including tutorials and FAQs, that serves as a readily available resource for users looking for immediate answers.

Furthermore, email support is frequently offered as a channel for more complex inquiries or situations requiring in-depth assistance from a dedicated support representative.

Effective communication and rapid responses are crucial for resolving merchant issues quickly and minimizing downtime.

The quality of the customer support process is directly tied to the overall merchant experience with the CardConnect platform and the ability to integrate seamlessly into their existing business workflow.

CardConnect recognizes that different merchants have varying needs, leading to the development of personalized support pathways based on the merchant’s tier or specific requirements.

This allows for greater efficiency in addressing specific concerns within the merchant’s particular business profile.

This commitment to efficiency extends to the promptness of issue resolution, which significantly impacts merchant satisfaction and their overall perception of the CardConnect service.

CardConnect’s support team is trained to understand the nuances of the payment processing industry and provide accurate, timely, and effective guidance to merchants.

By offering multiple channels for communication and support, CardConnect demonstrates a strong dedication to ensuring its clients receive exceptional support, which is a key element in driving customer loyalty and fostering long-term partnerships.

Consequently, robust customer support channels are vital to the success and overall efficiency of CardConnect’s payment processing services, directly influencing merchant satisfaction and the overall success of the business.

CardConnect Customer Service Support Channels

Effective customer service is crucial for any payment processing company, and CardConnect understands this fundamental principle.

The fourth key aspect of CardConnect’s customer service revolves around providing diverse and accessible support channels to facilitate seamless communication and issue resolution.

This includes options like phone support, email assistance, and a comprehensive knowledge base brimming with frequently asked questions (FAQs) and troubleshooting guides.

These channels are designed to cater to various customer needs and preferences, enabling prompt and efficient issue resolution regardless of the customer’s location or preferred method of communication.

CardConnect recognizes that technical issues, billing inquiries, and account management concerns often require specialized support, thus the varied support channels are crucial for timely and effective assistance.

A well-maintained knowledge base is vital in empowering customers to find solutions independently. This reduces the workload on support agents, ensuring faster response times to more complex inquiries.

Moreover, a dedicated support team, readily available to answer complex questions and resolve intricate problems, is an integral part of this comprehensive approach. This dedicated team complements the self-service options, providing a robust system for addressing all possible customer needs.

The availability of multiple CardConnect customer service support channels is a key strength. This multifaceted approach allows customers to connect with the company in a way that best suits their individual needs, guaranteeing a swift and effective resolution to their inquiries and concerns.

CardConnect’s commitment to robust support channels, encompassing phone, email, and a thorough knowledge base, demonstrates its dedication to customer satisfaction and underscores the importance of effective customer service within the payment processing industry.

CardConnect customer service plays a pivotal role in the success of businesses relying on its payment processing solutions.

The smooth operation of transactions, timely resolution of issues, and expert guidance directly impact merchant satisfaction and revenue generation.

A robust and responsive CardConnect support system fosters trust and encourages continued use of the platform, ultimately driving business growth.

Effective communication channels, knowledgeable representatives, and prompt issue resolution are critical components of a positive CardConnect customer service experience. Businesses must recognize the value of efficient, reliable support to maximize the benefits of their chosen payment processing platform.

In today’s competitive landscape, exceptional CardConnect customer service is not just a desirable feature; it’s a crucial differentiator that sets businesses apart. A well-managed support system ensures that merchants can focus on their core operations without being bogged down by technical difficulties or payment processing glitches. Understanding the intricacies of the CardConnect platform and navigating potential challenges effectively are greatly aided by helpful and accessible customer service.

Ultimately, a strong commitment to CardConnect customer service is essential for businesses to achieve their financial goals and navigate the complexities of the digital payment landscape successfully. Choosing a provider with a dedicated and effective support team is a strategic move that translates directly into business growth and success.