Navigating the complexities of financial transactions often necessitates the expertise of a dedicated TD Bank customer service representative.

These individuals play a crucial role in ensuring smooth interactions between clients and the bank, handling a wide array of inquiries and requests, from account management to loan applications.

Understanding the responsibilities and requirements for a TD Bank customer service rep is vital for both prospective employees and existing clients.

A well-trained and responsive TD Bank customer service rep can significantly impact a customer’s overall satisfaction and trust in the bank.

Their ability to efficiently resolve issues, provide clear and concise information, and maintain a professional demeanor is paramount in the banking industry.

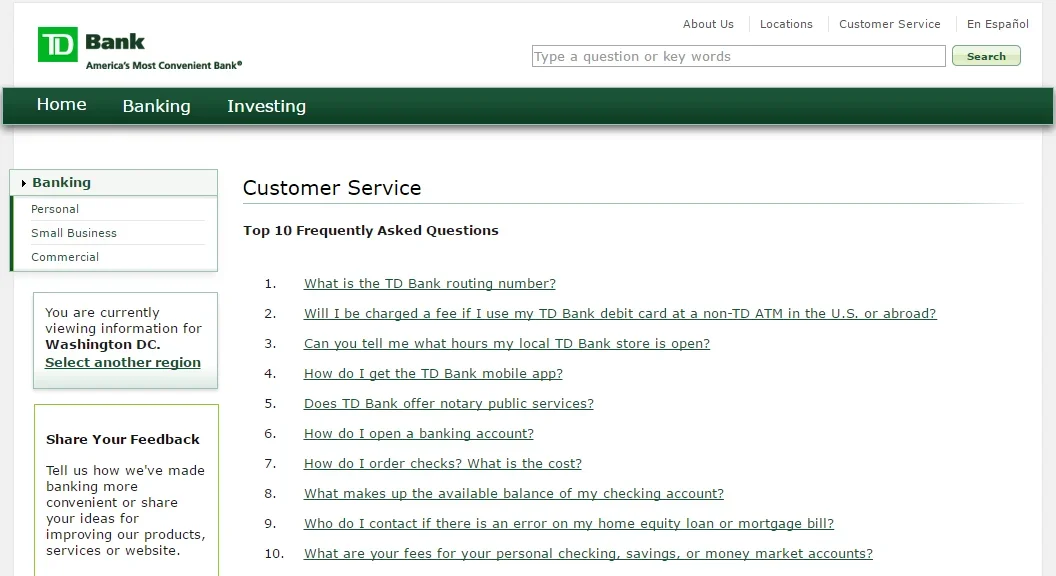

From troubleshooting technical glitches in online banking to guiding clients through complex financial products, the responsibilities of a TD Bank customer service rep are multifaceted and critical to the bank’s success.

The effectiveness of a TD Bank customer service representative directly affects the client experience, fostering loyalty and driving positive word-of-mouth referrals.

Whether you’re seeking a career in banking or simply looking to gain insight into how financial institutions operate, this exploration into the world of the TD Bank customer service rep offers valuable insights into the dynamic nature of customer service in the modern financial sector.

This article delves into the key attributes, training processes, and challenges faced by these dedicated professionals, offering a comprehensive perspective on the demanding but rewarding role of a TD Bank customer service rep.

Essential Skills and Responsibilities of a TD Bank Customer Service Rep

Effective communication is paramount for a TD Bank customer service representative, ensuring clients receive prompt and accurate information. A crucial aspect of this role involves handling diverse customer inquiries and requests, from routine account maintenance to complex financial transactions. This necessitates a comprehensive understanding of TD Bank’s products and services.

A TD Bank customer service rep is frequently the first point of contact for customers, acting as a vital link between the client and the bank. Their role extends beyond simply answering questions; it involves actively listening to customer concerns, empathizing with their needs, and providing tailored solutions. This proactive approach fosters a positive customer experience and builds trust.

Problem-solving abilities are also essential for a TD Bank customer service representative. They must demonstrate proficiency in resolving a wide array of issues, from simple account inquiries to more intricate problems involving loans or investments. This often requires a combination of technical knowledge and effective interpersonal skills.

A solid understanding of banking regulations and policies is essential for a TD Bank customer service representative. Adherence to these guidelines is critical for ensuring compliance and maintaining the bank’s reputation. Thorough knowledge of applicable laws and regulations also allows representatives to answer client questions accurately and maintain the integrity of the financial institution.

Time management and prioritization skills are highly valued in this role. TD Bank customer service reps frequently handle multiple requests simultaneously, requiring the ability to efficiently manage their time and prioritize tasks based on urgency and importance. This organized approach ensures that customers receive prompt attention to their needs.

Maintaining confidentiality and protecting sensitive client data is of utmost importance. A TD Bank customer service rep’s actions must adhere to strict confidentiality protocols. This includes safeguarding customer financial information and upholding the bank’s commitment to privacy. This responsibility underpins the trust and integrity of the entire financial institution.

Essential Skills and Responsibilities of a TD Bank Customer Service Rep

Effective communication forms the bedrock of a TD Bank customer service representative’s role.

This entails conveying information clearly and concisely to clients, ensuring their inquiries are answered accurately and promptly.

A deep understanding of TD Bank’s array of financial products and services is crucial for a customer service representative.

This knowledge allows the rep to address a wide range of customer needs, from simple account inquiries to intricate financial transactions.

Problem-solving abilities are indispensable for a TD Bank customer service representative.

The ability to identify and resolve customer issues effectively is paramount, ensuring a positive and satisfactory resolution for every interaction.

Active listening skills are a key component of successful customer service interactions at TD Bank.

Reps must actively listen to customers’ concerns, understanding their perspectives and tailoring responses to their specific needs.

Time management is essential for efficiently handling multiple customer inquiries concurrently.

Prioritizing tasks and adhering to service level agreements (SLAs) ensures prompt responses to customer needs.

A customer service rep at TD Bank must exhibit empathy and compassion in all interactions.

Understanding and addressing customer concerns with sensitivity and respect fosters a positive customer experience.

Technical proficiency is becoming increasingly important for TD Bank customer service representatives.

Familiarity with various online banking platforms, mobile apps, and other digital tools is essential for effectively supporting clients in a rapidly evolving financial landscape.

Building rapport with customers requires proactive engagement and personalized service.

TD Bank representatives must go beyond simply answering questions; they should create a positive, lasting impression.

Maintaining a professional and courteous demeanor is an integral part of this role.

Maintaining confidentiality and adhering to strict privacy protocols is paramount.

A strong ethical compass is vital for all TD Bank customer service representatives.

Adhering to banking regulations and maintaining the highest standards of integrity is necessary.

Knowledge of relevant financial laws and regulations is expected of a TD Bank customer service representative.

Collaboration with other departments within TD Bank is common for resolving complex issues.

The representative must be able to effectively communicate with colleagues from different departments to ensure a holistic approach to customer issues.

Adaptability is an important quality for TD Bank customer service reps.

The ability to adjust to changing circumstances and customer needs is a valuable asset.

Continuous learning and professional development are vital for TD Bank customer service representatives.

Keeping abreast of evolving financial products and services through training and staying updated with industry trends is a crucial element in the role.

A TD Bank customer service representative plays a pivotal role in shaping the bank’s reputation.

Positive interactions and efficient problem-solving contribute significantly to client satisfaction and loyalty within the TD Bank customer base.

TD Bank Customer Service Representative Efficiency and Handling of Complex Issues

A crucial aspect of TD Bank’s customer service performance lies in the efficiency and proficiency of their representatives in handling complex issues.

TD Bank customer service representatives play a vital role in resolving intricate customer problems, ranging from account disputes to loan modifications, ensuring a positive customer experience.

The ability of these TD Bank customer service reps to effectively navigate complex situations directly impacts customer satisfaction and loyalty.

Efficiency in addressing complex matters, such as fraudulent activity investigations or intricate account reconciliation issues, requires a combination of technical knowledge, problem-solving skills, and interpersonal abilities.

Well-trained TD Bank customer service representatives are expected to quickly identify the root cause of a problem, gather necessary information from the customer, and provide solutions that align with TD Bank policies and procedures.

This includes thoroughly understanding bank regulations, product offerings, and resolving disputes fairly and promptly.

Furthermore, representatives need to remain calm and professional under pressure, especially when dealing with irate or frustrated customers.

Strong communication skills are paramount; representatives must explain complex information in a clear and concise manner to ensure that the customer understands the resolution and future steps.

TD Bank’s reputation hinges on the capacity of its representatives to manage multifaceted inquiries. Effective problem resolution through these representatives translates to improved customer retention.

A TD Bank customer service rep’s ability to handle complex issues effectively demonstrates their commitment to providing excellent service.

Their mastery of procedures, their knowledge of the products, and their communication skills are key in shaping a positive perception of the bank among clients.

TD Bank benefits from a team of skilled customer service representatives who are adept at handling a wide range of intricate issues.

This translates into higher customer satisfaction, reduced customer complaints, and a stronger brand reputation for TD Bank.

Efficiently dealing with these complex issues often necessitates collaboration with other departments within TD Bank, for example, working with loan officers to modify loan terms or collaborating with fraud prevention teams to address suspicious activity.

Ultimately, the proficiency of TD Bank customer service reps in addressing these issues directly correlates to the overall success and satisfaction of the bank’s customer base.

Investing in training and development for TD Bank customer service representatives ensures that they possess the necessary skills to confidently handle challenging situations and provide optimal solutions for customers.

Effective Communication Skills for TD Bank Customer Service Reps

Effective communication is paramount for TD Bank customer service representatives, forming the bedrock of positive interactions and successful resolution of customer issues.

A key component of this communication is active listening, which involves fully concentrating on what the customer is saying, both verbally and nonverbally. This includes paying close attention to the customer’s tone of voice and body language to understand their underlying needs and emotions.

Furthermore, clear and concise communication is crucial, allowing the TD Bank customer service rep to convey information accurately and in a manner easily understood by the customer. This involves using plain language, avoiding jargon, and providing specific details to ensure the customer feels well-informed and understood.

Empathy is essential for a TD Bank customer service representative, enabling them to understand the customer’s situation from their perspective and respond with compassion. This ability to acknowledge and validate the customer’s feelings fosters a sense of trust and rapport.

Proficient TD Bank customer service reps also demonstrate excellent problem-solving skills, coupled with a strong understanding of company policies and procedures. This allows them to quickly identify solutions while respecting the bank’s guidelines.

A TD Bank customer service representative’s ability to effectively communicate is directly linked to customer satisfaction and loyalty. Clear and compassionate communication, combined with a thorough understanding of company policies, builds customer trust and strengthens the customer relationship, ultimately improving the bank’s reputation.

The proper application of these skills allows TD Bank customer service representatives to effectively navigate complex customer issues, ensuring resolution and a positive experience for all involved.

By consistently demonstrating excellent communication skills, TD Bank representatives can proactively address customer concerns, building lasting relationships and cultivating customer loyalty.

TD Bank customer service representatives play a critical role in shaping the customer experience and ultimately, the bank’s success.

Their ability to effectively address customer inquiries, resolve issues, and provide helpful guidance directly impacts customer satisfaction and loyalty.

From navigating complex financial transactions to handling sensitive account concerns, the professionalism and empathy exhibited by TD Bank’s customer service reps are paramount.

The efficient and friendly resolution of customer issues fosters a positive perception of the bank, building trust and encouraging repeat business. A well-trained and empowered TD Bank customer service rep can significantly influence a customer’s overall view of the institution.

In today’s competitive financial landscape, a positive customer service experience is no longer a mere desirable quality; it’s a necessity. The dedicated TD Bank customer service rep forms the front line of this critical interaction, ensuring the bank maintains its reputation and attracts and retains valued customers.

In conclusion, the competence and dedication of TD Bank customer service representatives are essential to maintaining a strong customer base and ensuring the long-term success of the institution. Their contributions, in many ways, define the bank’s reputation and influence customer engagement throughout the entire banking relationship.

Ultimately, the quality of service delivered by a TD Bank customer service rep directly impacts the financial institution’s success and its position within the market.